Historic Breakthrough of $100,000: How Much Further Can Bitcoin Rise?

Summary:

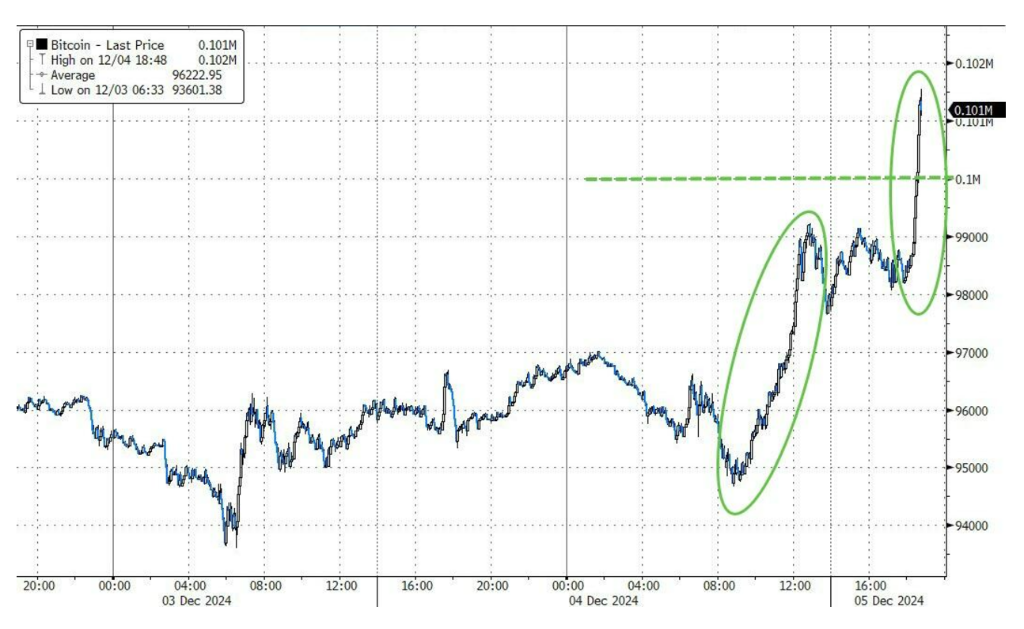

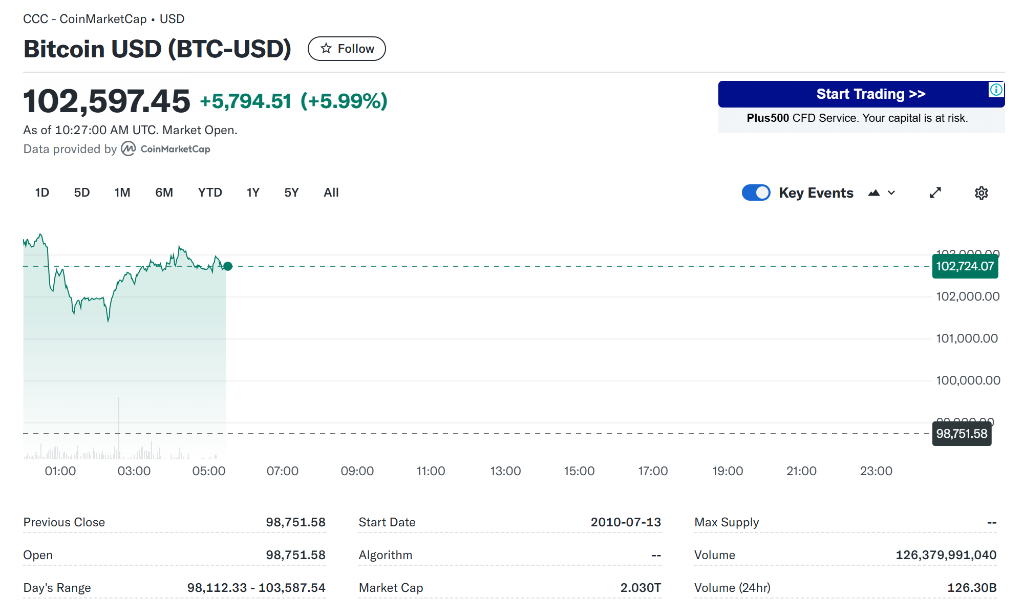

The $100,000 milestone has pushed Bitcoin’s market capitalization close to $2 trillion, surpassing tech giants like Nvidia, Apple, and Google. Analysts believe this marks a new phase in the bull market, with Bitcoin appearing "immune to any external shocks." Over the past two weeks, Bitcoin has hovered around the critical “round number” level. On Thursday, it decisively broke through the $100,000 mark.

With Paul Atkins nominated by Trump to chair the SEC, the market has reacted swiftly to this personnel change, fueling optimism among investors regarding the U.S. cryptocurrency regulatory landscape.

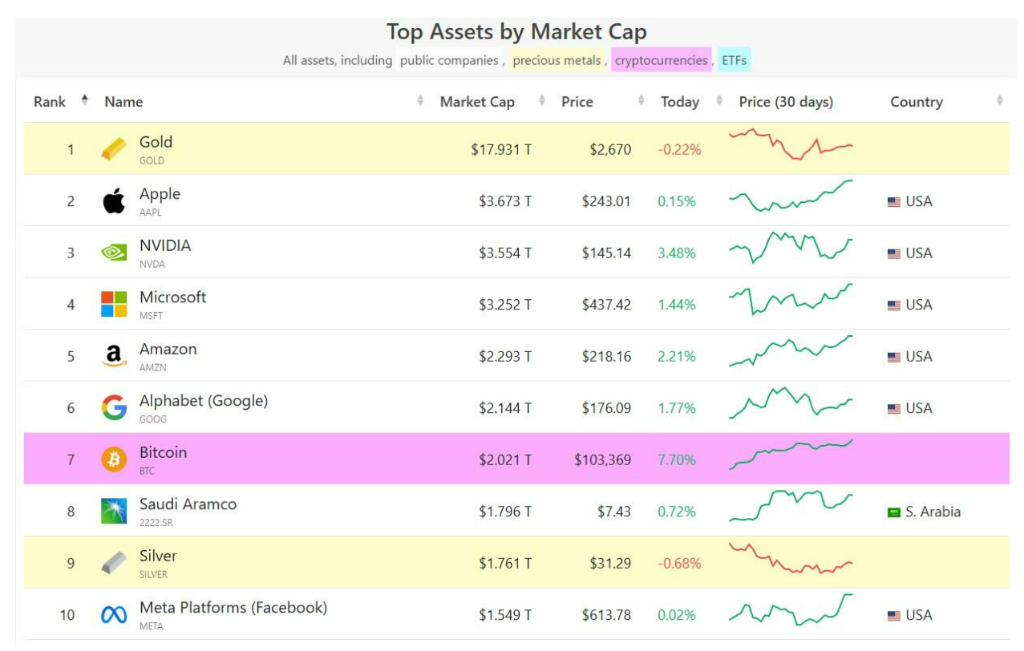

Since Trump’s victory in the presidential election last month, Bitcoin has surged by more than 40%, repeatedly nearing $100,000. At the time of publication, Bitcoin had risen to $102,600 per coin. This milestone boosted Bitcoin’s market capitalization close to $2 trillion, surpassing Nvidia, Apple, and Google. A $2 trillion valuation also makes Bitcoin larger than the government bond markets of Spain and Brazil and comparable to the total market capitalization of the UK’s FTSE 100 index. Bitcoin’s market cap has even overtaken that of Saudi Aramco.

Fadi Aboulfa, Head of Research at cryptocurrency custody firm Copper Technologies Ltd., commented, “Bitcoin surpassing $100,000 marks the start of a new phase in the bull market. It now appears immune to any external shocks.”

Bull Market Momentum

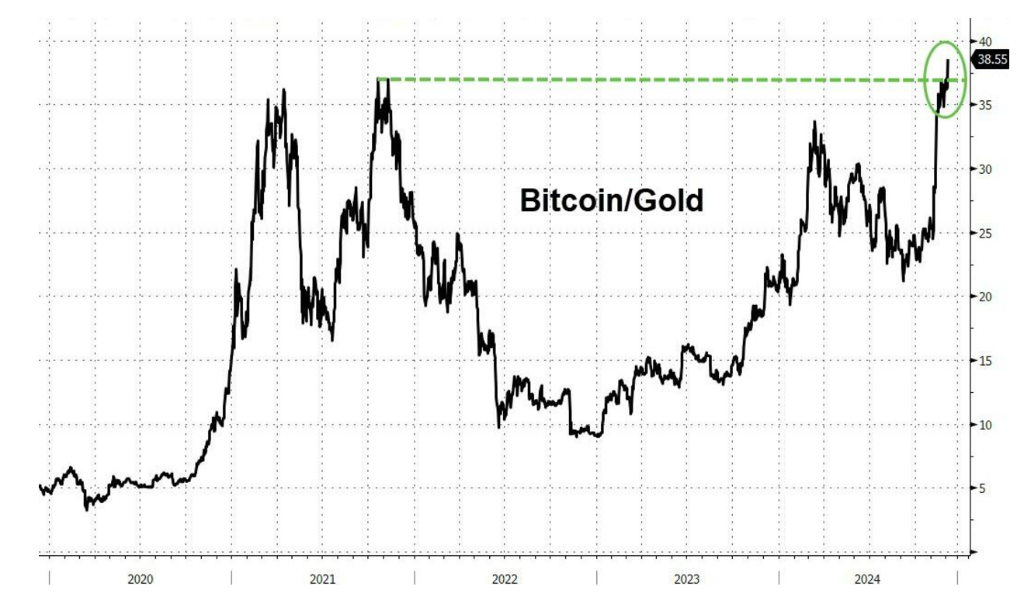

Since Trump’s election victory, the cryptocurrency market has grown by approximately $1.4 trillion. Bitcoin’s $100,000 price point has pushed its market cap close to $2 trillion, exceeding major tech companies like Nvidia, Apple, and Google. This valuation even surpasses the bond markets of Spain and Brazil and approaches the UK FTSE 100 index’s total market value. Bitcoin’s resurgence has also driven its Bitcoin-to-

Gold ratio to a record high.

Manuel Villegas, a digital asset analyst at Julius Baer, stated, “Next year, the cryptocurrency market may face a supply squeeze, reminiscent of last year when strong demand far outpaced supply.”

The “Trump Trade” Fuels Digital Asset Market

Bitcoin previously set a record high of $73,000 in March this year, marking a strong recovery from its nearly 80% decline between November 2021 and November 2022.

During the crypto winter, the industry faced significant challenges, including the collapse of FTX, bankruptcies of lenders like Genesis and Celsius, and stringent regulatory crackdowns. Sam Bankman-Fried, FTX’s founder, was sentenced to 25 years in prison for fraud, while Binance’s founder, Changpeng Zhao, faced penalties for anti-money laundering oversights.

Despite these setbacks, Trump’s unexpected victory reignited the cryptocurrency market’s fervent recovery. Bitcoin has been a central component of the “Trump Trade,” which aligns with Trump’s campaign pledge to prioritize the establishment of a national Bitcoin reserve.

Trump’s transition team is considering placing the cryptocurrency industry in an unprecedented spotlight. They are exploring the creation of a new position, the “Crypto Czar,” to lead a small team and serve as a liaison between Congress, the White House, and various cryptocurrency regulators.

Meanwhile, the Financial Times reported last month that Trump Media and Technology Group (DJT) is in advanced negotiations to acquire the crypto trading company Bakkt (BKKT). This collaboration could further energize market enthusiasm.

Even before Trump’s election, many industry insiders anticipated Bitcoin’s potential to surpass $100,000. Hedge fund manager Anthony Scaramucci, billionaire Mike Novogratz, and strategists from institutions like JPMorgan and Goldman Sachs publicly expressed similar views.

Recently, Bitcoin spot ETFs have attracted substantial capital, driving its price surge. Options tied to BlackRock’s spot Bitcoin ETF have also debuted on Nasdaq, further fueling trading momentum.

Risks Remain

Despite the optimistic outlook, Oppenheimer analyst Lau warned investors that Bitcoin’s price might face volatility after breaking significant thresholds. He specifically noted:

“Once Bitcoin hits $100,000, investors should exercise caution. There may be selling pressure as the market seeks its next breakout point.”

Risk Disclaimer

Markets carry risks, and investments should be approached with caution. This article does not constitute personalized investment advice and does not account for individual investment objectives, financial situations, or needs. Users should evaluate whether any opinions, views, or conclusions in this article are suitable for their circumstances. Investments made based on this article are at the investor's own risk.