Significant Rate Cut of 50 Basis Points! The Federal Reserve Kicks Off Easing Cycle with an Aggressive First Step

The Federal Reserve lowered the federal funds rate target range by 50 basis points to 4.75%-5.00%.

Federal Reserve Dot Plot: Another 50 basis points rate cut expected in 2024.

The Fed Raises Unemployment Forecast for 2024 to 4.4%.

The Fed Lowers U.S. GDP Growth Forecast for 2024 to 2.0%.

The Fed Lowers Core PCE Inflation Forecast for 2024 to 2.6%.

As anticipated by the market, the Federal Reserve has initiated the easing cycle, marking the first rate cut in four years. Even more exciting for the market is that the Fed started with an extraordinary 50 basis point cut.

On Wednesday, September 18 (Eastern Time), the Federal Reserve announced after its FOMC meeting that the target range for the federal funds rate would be lowered from 5.25%-5.50% to 4.75%-5.0%, a 50 basis point cut. This is the first rate cut since the Fed began its tightening cycle in March 2022. From March 2022 to July last year, the Fed raised rates 11 times consecutively, totaling 525 basis points, keeping rates at their highest level since 2001 for eight consecutive meetings.

The FOMC statement indicated that confidence in inflation control has increased, with inflation steadily moving towards 2%. The risks to both employment and inflation goals are viewed as balanced.

After the rate decision was announced, U.S. stocks extended their gains. The Nasdaq rose by more than 1%, the S&P 500 index gained 0.72%, and the Dow Jones Industrial Average was up 0.74%. Spot gold also extended its daily gains, rising 1% to $2,595.15 per ounce, hitting a new all-time high.

Federal Reserve Dot Plot: Another 50 Basis Point Rate Cut Expected in 2024

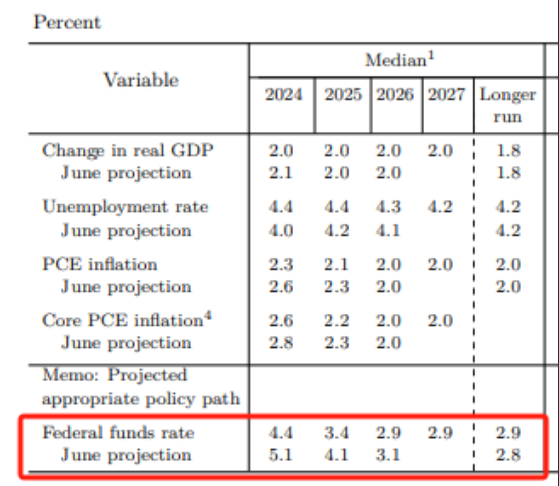

The much-watched "dot plot" of rate forecasts shows that the median forecast from 19 policymakers for the end of 2024 puts the federal funds rate in the 4.25%-4.5% range. This implies that they collectively expect another 50 basis point rate cut by the end of the year.

The median forecast also indicates that these policymakers believe the rate will be in the 3.25%-3.5% range by the end of 2025, suggesting a cumulative 100 basis point rate cut in 2025. By 2026, they expect a 50 basis point rate cut, with rates stabilizing between 2.75%-3% in the long term.

The Fed Raises the 2024 U.S. Unemployment Rate Forecast to 4.4%

The Fed projects the unemployment rate will be 4.4% in 2024 (up from 4.0% projected in June); 4.4% in 2025 (up from 4.2% in June); 4.3% in 2026 (up from 4.1% in June); and 4.2% in the long term (unchanged from June).

The Fed Lowers U.S. GDP Growth Forecast to 2.0% for 2024

The Fed projects U.S. GDP growth at 2.0% in 2024 (down from 2.1% in June); 2.0% in 2025 (unchanged from June); 2.0% in 2026 (unchanged from June); 2.0% in 2027; and long-term U.S. GDP growth at 1.8% (unchanged from June).

The Fed Lowers U.S. Core PCE Inflation Forecast to 2.6% for 2024

The Fed expects core PCE inflation to be 2.6% in 2024 (down from 2.8% in June); 2.2% in 2025 (down from 2.3% in June); 2.0% in 2026 (unchanged from June); and 2.0% in 2027. The Fed projects overall PCE inflation to be 2.3% in 2024 (down from 2.6% in June); 2.1% in 2025 (down from 2.3% in June); 2.0% in 2026 (unchanged); and 2.0% in 2027, with a long-term inflation forecast of 2.0% (unchanged from June).

"Fed Whisperer" on the Bold Start of the Rate-Cutting Cycle

Nick Timiraos of the "new Fed communications" reported that the Fed voted to cut rates by 50 basis points, the first rate cut since 2020, marking a bold start to the rate-cutting cycle. Eleven out of the 12 voting members of the FOMC supported this decision, lowering the benchmark federal funds rate to the 4.75%-5% range. The quarterly projections released on Wednesday show that most officials expect to cut rates by at least 25 basis points at the November and December meetings. This decision firmly puts the Fed in a new phase: attempting to prevent last year’s rate hikes (which pushed borrowing costs to their highest levels in 20 years) from further weakening the U.S. labor market.

Following the announcement of the Fed's decision, U.S. stocks extended their gains. The Nasdaq rose more than 1%, the S&P 500 index gained 0.72%, and the Dow Jones Industrial Average increased by 0.74%.

Full Text of the Federal Reserve's Decision: 50 Basis Point Rate Cut, Committed to Maximizing Employment

Recent indicators suggest economic activity continues to expand at a solid pace. While job growth has slowed and the unemployment rate has slightly increased, it remains at a low level. Inflation has further moved toward the committee’s 2% goal but remains slightly above target.

The committee's goal is to achieve maximum employment and 2% inflation over the long term. The committee is confident that inflation is steadily moving toward the 2% goal and considers the risks to employment and inflation to be roughly balanced. Given the uncertainty surrounding the economic outlook, the committee is highly attentive to the dual risks of its mandate.

Given the progress in inflation and the balanced risks, the committee decided to lower the target range for the federal funds rate by 50 basis points to 4.75%-5%. In considering further adjustments to the target range, the committee will carefully evaluate incoming data, changes in the economic outlook, and the balance of risks. The committee will continue to reduce its holdings of Treasury securities, agency debt, and agency mortgage-backed securities. The committee remains firmly committed to maximizing employment and bringing inflation back to its 2% target.

In assessing the appropriate stance of monetary policy, the committee will continue to monitor the implications of incoming information for the economic outlook. If risks emerge that could impede the achievement of the committee’s goals, it is prepared to adjust the stance of monetary policy as appropriate. The committee's evaluation will take into account a wide range of information, including labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Those supporting the monetary policy action included: Chair Jerome Powell, Vice Chair John C. Williams, Thomas I. Barkin, Michael S. Barr, Raphael W. Bostic, Lisa D. Cook, Mary C. Daly, Beth M. Hammack, Philip N. Jefferson, Adriana D. Kugler, and Christopher J. Waller. The lone dissenter was Michelle W. Bowman, who favored a 25 basis point cut at this meeting instead of 50.